INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Rule 14a-6(e)(2)) | |||

| x Definitive Proxy Statement | ||||

| o Definitive Additional Materials | ||||

| o Soliciting Material under Rule 14a-12 | ||||

Commonwealth Industries, Inc.

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

March 17, 200326, 2004

Dear Fellow Stockholder:

You are cordially invited to the annual meeting of stockholders of Commonwealth Industries, Inc. to be held at Kentucky International Convention Center, Room 112, 221 Fourth Street, Louisville, Kentucky on Friday, April 25, 200323, 2004 commencing at 10:00 a.m. Eastern Daylight Savings Time. The Board of Directors and management look forward to greeting those of you who are able to attend in person.

At the meeting you will be asked to: (i)(1) elect two directors to serve until the annual meeting of stockholders in 2006; (ii) approve an amendment of the 1997 Stock Incentive Plan;2007 and (iii)(2) ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2003.2004. Information concerning those matters, as well as other important information, is contained in the accompanying proxy statement, which you are urged to read carefully. In addition to voting, there will also be a report on major developments in 20022003 and answers to your questions.

Whether or not you plan to attend in person and regardless of the number of shares you own, it is important that your shares be represented and voted at the annual meeting. Stockholders who do not attend the meeting have a choice of voting over the Internet, by telephone or by using a proxy card. Please refer to your proxy card or the information forwarded to you by your bank, broker or other holder of record to see which options are available to you. Your vote is important and you are requested to vote your shares at your earliest convenience. Your shares will then be represented at the annual meeting and the Company will be able to avoid the expense of further solicitation.

On behalf of the Board of Directors, thank you for your cooperation and continued support.

Sincerely,

Mark V. Kaminski

COMMONWEALTH INDUSTRIES, INC.

NOTICE OF 20032004 ANNUAL MEETING OF STOCKHOLDERS

The 20032004 annual meeting of stockholders of Commonwealth Industries, Inc. (the “Company”) will be held at Kentucky International Convention Center, Room 112, 221 Fourth Street, Louisville, Kentucky at 10:00 a.m. Eastern Daylight Savings Time on Friday, April 25, 200323, 2004 to consider and take action with respect to the following matters:

| 1. | Election of two directors, each for a term of three years; | |||

| 2. | ||||

| Ratification of the Audit Committee’s appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for | ||||

| Such other business as may properly be brought before the meeting or any adjournment thereof; | ||||

all as set forth in the proxy statement accompanying this notice.

The close of business on March 7, 20035, 2004 has been fixedset as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment thereof. This proxy statement is being mailed to those stockholders on or about March 17, 2003.26, 2004.

Stockholders who do not expect to attend the meeting are requested to vote their shares over the Internet, by telephone or by proxy card.

By order of the Board of Directors,

Lenna Ruth Macdonald

March 17, 2003

TABLE OF CONTENTS

| 1 | ||||

| 4 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 22 | ||||

| 33 | ||||

| 33 | ||||

| 34 |

COMMONWEALTH INDUSTRIES, INC.

PROXY STATEMENT

This proxy statement is furnished to you in connection with the solicitation of proxies by the Board of Directors of Commonwealth Industries, Inc. (the “Company”) to be used at the 20032004 annual meeting of stockholders to be held in Louisville, Kentucky at 10:00 a.m. Eastern Daylight Savings Time on Friday, April 25, 2003.23, 2004.

Who can vote at the meeting?

Stockholders who were owners of record of common stock of the Company at the close of business on March 7, 20035, 2004 are entitled to receive notice of and may attend and vote at the meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held at the meeting or any postponement or adjournment of the meeting.meeting all of the shares that you held on the record date. Each share is entitled to one vote.

When is this proxy statement first being sent to stockholders?

This proxy statement is first being mailed to stockholders on or about March 17, 2003.26, 2004.

What is in this proxy statement?

You are being asked to: (1) elect two members of the Board of Directors;Directors and (2) approve an amendment of the 1997 Stock Incentive Plan to increase the number of shares authorized for awards of options and stock to key employees and options and unrestricted stock to non-employee directors; and (3) ratify the Audit Committee’s appointment of independent auditors for 2003.2004. This proxy statement gives you information on the proposals, as well as other information, so you can make an informed decision.

How do I vote?

Your vote is important. Because many stockholders cannot attend the meeting in person, it is necessary that stockholders be represented by proxy. Most stockholders have a choice of voting over the Internet, throughusing a toll-free telephone number or completing a proxy card and mailing in the postage-paid envelope provided.provided or attending the meeting and voting in person. Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available.available to you.

You may vote over the Internet or by telephone.

The Internet and telephone voting procedures are designed to authenticate each stockholder by use of a control number and to allow you to confirm that your instructions have been properly recorded. Please be aware that if you vote over the Internet, you might incur costs such as telephone and Internet access charges for which you will be responsible.

1

You may vote by mail.

You may vote in person at the meeting.

1

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent or with stockbrokers.

How do I vote if I participate in one of the employee savings or 401(k) plans?

The plans’ independent trustee will vote your Company employee savings plan shares according to your voting instructions. The trustee will vote plan shares not voted by proxy as the Board of Directors recommends.

Can I change my vote?

Yes. You may revoke your proxy and change your vote at any time before the meeting by: (1) mailing a revised proxy card dated later than the prior proxy card (including an Internet or telephone vote) and returning it before the polls close at the meeting, or (2) voting in person at the meeting.

If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed proxy will be voted as the Board of Directors recommends. If any other matters are properly presented for consideration at the annual meeting, including consideration of a motion to adjourn the meeting to another time or place, the persons named as proxies and acting thereunder will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. On the date thisthe proxy statement went to press, the Company did not anticipate that any other matters would be raised at the annual meeting.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts listed with the transfer agent or with stockbrokers.

How do I vote if I participate in one of the Company employee savings or 401(k) plans?

The plans’ independent trustee will vote your employee plan shares according to your voting instructions. The trustee will vote plan shares not voted by proxy as the Board of Directors recommends.

Can I change my vote?

Yes. You may revoke your proxy and change your vote at any time before the meeting by: (1) mailing a revised properly executed, later-dated proxy card (including an Internet or telephone vote) and returning it before the polls close at the meeting or (2) voting in person at the meeting.

If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed proxy will be voted as the Board of Directors recommends: (1) for the named nominees for directors and (2) for ratification of the Audit Committee’s appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2004.

What constitutes a quorum for the meeting?

A majority of the outstanding shares entitled to vote, present or represented by proxy, constitutes a quorum. Abstentions or broker “non-votes” are counted as present and entitled to vote for purposes of determining whether a quorum exists. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. A quorum is necessary to conduct business at the meeting. You are part of the quorum if you have voted by proxy. As of the record date for the meeting, there were 16,010,97116,020,397 shares of common stock of the Company outstanding and entitled to vote.

2

What is the appropriate conduct for the meeting?

In order to ensure that the annual meeting is conducted in an orderly fashion and that stockholders wishing to speak at the meeting have a fair opportunity to speak, the Company will have certain guidelines and rules for the conduct of the meeting.

What vote is required to approve each item?

Election of Directors.directors.

Approval of an amendment of the 1997 Stock Incentive Plan.

Ratification of appointment of independent auditors.

How are the votes counted?

Voting results are tabulated and certified by National City Bank. In addition, the Company’s Inspectors of Election will tabulate the votes cast at the meeting, together with the votes cast by proxy.

Are the proxy materials and annual report available electronically?

This proxy statement and the 20022003 annual report are available on ourthe Company’s website on the Investor Relations — Financial Reports page at www.ciionline.com/Investor Relations/Financial Reports. Mostwww.ciionline.com. Registered stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail.

If you are a registered stockholder of record, you can choose this option and save the Company the cost of producing and mailing these documents by completing the portion of your proxy card or by following the instructions provided if you votewhen voting over the Internet.Internet or by telephone. You

2

If you choose to view future proxy statements and annual reports over the Internet, you will receive a proxy card in the mail next year with instructions containing the Internet address of those materials. Your choice will remain in effect until you call the Commonwealth ShareownerShareholder Services toll-free number 800-622-6757, write to National City Bank, Corporate Trust Operations, Department 5352, Post Office Box 92301, Cleveland, Ohio 44193-0900 or contact the Company.

Who pays for the solicitation of proxies?

The Company is paying for the preparation, distribution and solicitation of proxies. The Company expects fees and expenses for this process to be approximately $25,000.$15,000. The Company is not using an outside proxy solicitation firm this year, but employees of the Company or its subsidiaries may solicit proxies through mail, telephone or other means. Employees do not receive additional compensation for soliciting proxies. As part of this process, the Company reimburses brokers, nominees, fiduciaries and other custodians for reasonable fees and expenses in forwarding proxy materials to stockholders.

3

GOVERNANCE OF THE COMPANY

BOARD OF DIRECTORSOur Board of Directors believes that the purpose of corporate governance is to ensure that the Company maximizes stockholder value in a manner consistent with legal requirements and the highest standards of integrity. The board has adopted and adheres to Corporate Governance Guidelines which the board and management believe promote this purpose, are sound and represent best practices. The Company continually monitors and reviews these guidelines, the laws of Delaware (the Company’s state of incorporation), the rules and listing standards of the Nasdaq Stock Market, Inc. (“Nasdaq”) and the regulations of the Securities and Exchange Commission (“SEC”), as well as best practices suggested by recognized governance authorities. The board-adopted Corporate Governance Guidelines document was attached as an exhibit to the 2003 proxy statement and can be viewed on the Company’s website on the Investor Relations — Corporate Governance page at www.ciionline.com.

The Board of Directors, in accordance with the provisions of the Company’s Restated Certificate of Incorporation and By-laws,by-laws, is comprised of seven directors. The Boardboard has determined that each of its members, other than Mark V. Kaminski, the Company’s President and Chief Executive Officer, meets independence standards under Nasdaq rules.

The board is divided into three classes and members of each class hold office for a term of three years. The term of one class expires each year. MeetingsDirectors are encouraged to attend the Company’s annual meetings of stockholders and all six of the Board are held on a regular basis and special meetings are held when necessary. The organizational meeting follows immediately afterdirectors attended the annual meeting of stockholders.in 2003.

The Board of Directors has responsibility for establishing broad corporate policies and for the overall strategic direction of the Company, although it is not involved in day-to-day operations. Members of the Boardboard are kept informed of the Company’s business by reviewing materials and various documents, by participating in meetings of the Board of Directors and its committees, and through discussions regarding operatingoperations and financial reports made at Boardboard and committee meetings by the Chief Executive Officer, the Chief Financial Officer and other members of management.

Stockholders may communicate with any of the Company’s directors, the board as a group or any board committee as a group by: (1) sending an e-mail to the board, a particular director or committee at Directors@ciionline.com or (2) mailing correspondence c/o Corporate Secretary, Commonwealth Industries, Inc., PNC Plaza — 19th Floor, 500 West Jefferson Street, Louisville, Kentucky 40202 or (3) calling and leaving a voicemail message on the Company’s compliance information line toll-free number 866-912-4357. The board has delegated to the Corporate Secretary, or her designee, responsibility for determining in her discretion whether the communication is appropriate for director, committee or board consideration. According to the policy adopted by the board, the Corporate Secretary is required to direct all communications regarding personal grievances, administrative matters, the conduct of the Company’s ordinary course of business operations, billing issues, product or service related inquiries, order requests and similar issues to the appropriate individual within the Company. All other communications are to be submitted to the board as a group, to the particular director or committee to whom it is addressed or, if appropriate, to the director or committee the Corporate Secretary believes to be the most appropriate recipient, as the case may be. If you send an e-mail or letter or leave a voicemail message to the board, a committee or a director, you will receive a written acknowledgement from the Corporate Secretary’s office confirming receipt of your communication.

4

COMMITTEES AND MEETINGS OF THE BOARD

The Board of Directors met eleven times in 2003 and the number of meetings each committee held are reflected in the following table. Attendance by directors at board and committee meetings averaged over 95%. All directors attended at least 91% of the board and committee meetings. The Board of Directors has reviewed its corporate governance policiesthe following standing committees: Audit Committee, Management Development and practices in the context of the adoption of the Sarbanes-Oxley Act of 2002Compensation Committee and effectiveNominating and proposed rule changes made by the Securities and Exchange Commission (“SEC”) and NASDAQ. The Board of Directors will continue to monitor rule changes and developing standards to incorporate final rule changes and best practices in this area. In October 2002, the Board of Directors adopted Corporate Governance Guidelines, which document can be viewedCommittee. Only independent directors serve on these committees, meeting Nasdaq standards for independence. The following table describes the Company’s website at www.ciionline.com/Investor Relations/Corporate Governance and which document is attached as Exhibit A to this proxy statement.board’s standing committees:

| COMMITTEE | MEETINGS | |||||||

| NAME | MEMBERS | FUNCTIONS OF THE COMMITTEE | IN 2003 | |||||

| Audit | C. Frederick Fetterolf, | • Appoints and terminates the independent auditors | ||||||

| Committee | Chair | • Reviews with independent auditors the plans for and results of the audit engagement | 15 | |||||

| Steven J. Demetriou Larry E. Kittelberger | • Approves professional services and fees to be rendered by the independent auditors and fees associated therewith | |||||||

| Paul E. Lego | • Reviews the independence and performance of independent auditors | |||||||

| • Reviews the adequacy of internal controls of the Company and its subsidiaries, including systems for monitoring risk, financial control and compliance with law | ||||||||

| • Monitors potential conflicts of interest of directors and management | ||||||||

| • Oversees the process of disclosure and communications | ||||||||

| • Reviews with independent auditors and management critical accounting policies and practices | ||||||||

| • Reviews with independent auditors and management major issues regarding accounting principles and financial statement presentations | ||||||||

| • Reviews the Company’s compliance program and procedures for receipt, retention and treatment of confidential complaints received by the Company | ||||||||

| • Performs such other duties as may be assigned from time to time by the board | ||||||||

5

| COMMITTEE | MEETINGS | |||||||

| NAME | MEMBERS | FUNCTIONS OF THE COMMITTEE | IN 2003 | |||||

| Management Development | Catherine G. Burke, Chair | • Provides oversight of management development and compensation and of human resources policies of the Company | ||||||

| and Compensation | Steven J. Demetriou C. Frederick Fetterolf | • Reviews and determines compensation and other benefits for the Chief Executive Officer and all other executive officers | 6 | |||||

| Committee | Paul E. Lego | • Determines or administers the Company’s incentive plans | ||||||

| • Determines whether to engage advisors or experts, as it deems appropriate, to discharge its duties and responsibilities | ||||||||

| • Performs such other duties as may be assigned from time to time by the board | ||||||||

| COMMITTEE | MEETINGS | |||||||

| NAME | MEMBERS | FUNCTIONS OF THE COMMITTEE | IN 2003 | |||||

| Nominating and | John E. Merow, Chair | • Makes recommendations to the board regarding the appropriate size and composition of the board | ||||||

| Corporate Governance | Catherine G. Burke Larry E. Kittelberger | • Recommends to the board candidates for election as directors or nominees to fill vacancies occurring between annual meetings | 5 | |||||

| Committee | Paul E. Lego | • Considers all nominees for director recommended by stockholders if submitted in compliance with the Company’s by-laws | ||||||

| • Recommends to the board candidates for appointment as chair and members of other board committees | ||||||||

| • Establishes procedures for the committee to exercise oversight of evaluation of the board and management | ||||||||

| • Monitors the corporate governance principles and makes recommendations to the board for changes when appropriate | ||||||||

| • Administers the board’s self-evaluation and shares the results thereof with the board for discussion and deliberation | ||||||||

| • Determines whether to engage special counsel or other experts or consultants, as it deems appropriate, to discharge its duties and responsibilities | ||||||||

| • Performs such other duties as may be assigned from time to time by the board | ||||||||

6

ITEMPROPOSAL 1: ELECTION OF DIRECTORS

At the annual meeting, two directors are to be elected. The terms of Catherine G. BurkePaul E. Lego and LarryJohn E. KittelbergerMerow expire at the meeting. Nominees for election this year are Dr. BurkeMessrs. Lego and Mr. Kittelberger.Merow. Each nominee has consented to serve, if elected, for a three-year term that will expire in 2006.2007. If a director should unexpectedly become unable or unwilling to serve, the proxy holders maycan vote for such other person as the Nominating and Corporate Governance Committee may recommend in place of such director. Additionally, in lieu of designating a substitute, the Boardboard may amend the By-lawsby-laws to reduce the number of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR” “FOR” THE NOMINEES.

4

THE NOMINEES

| THE NOMINEES | ||||

| Paul E. Lego Chairman of the Board; President, Intelligent Enterprises; Retired Chairman of the Board and Chief Executive Officer, Westinghouse Electric Corporation Director since 1995 Committees – Audit; Management Development and Compensation; Nominating and Corporate Governance Age: 73 | Expiration of term, if elected, 2007. From 1990 until his retirement in 1993, Mr. Lego was Chairman of the Board of Directors and Chief Executive Officer of Westinghouse Electric Corporation. He is a Director, Chairman of the Finance Committee and member of the Compensation Committee of Lincoln Electric Holdings, Inc. Mr. Lego is an Emeritus Trustee of the University of Pittsburgh and a member of the American Society of Corporate Executives. | ||

| John E. Merow Retired Chairman and Senior Counsel, Sullivan & Cromwell LLP Director since 1995 Committee – Nominating and Corporate Governance, Chair Age: 74 | Expiration of term, if elected, 2007. Mr. Merow was a Partner in the law firm of Sullivan & Cromwell LLP from 1965 through 1996, and Chairman and Senior Partner from 1987-1994. Mr. Merow is a Director of each of the investment companies (23) in the Seligman Group Investment Companies and a member of their Audit Committees and the Board Operations Committees. He is also an Executive Committee member and Secretary of the United States Council for International Business, a Trustee of New York-Presbyterian Hospital and Vice Chairman of New York-Presbyterian Healthcare System, Inc. | ||

7

| CONTINUING DIRECTORS | ||||

| Catherine G. Burke Associate Professor, School of Policy, Planning and Development, University of Southern California Director since 1995 Committees – Management Development and Compensation, Chair; Nominating and Corporate Governance Committee Age: | Expiration of term, | ||

| Steven J. Demetriou President and Chief Executive Officer, Noveon, Inc. Director since 2002 Committees – Audit; Management Development and Compensation Age: 45 | Expiration of term, 2005. Mr. Demetriou has been President, Chief Executive Officer and Director of Noveon, Inc. since 2001. He served as Executive Vice President of IMC Global Inc. and President of IMC Crop Nutrients from 1999 to 2001. Mr. Demetriou served in a number of leadership positions with Cytec Industries Inc. from 1997 to 1999. From 1981 to 1997, Mr. Demetriou held various positions with Exxon Corporation. | ||

| C. Frederick Fetterolf Retired President and Chief Operating Officer, Aluminum Company of America (Alcoa) Director since 1997 Committees – Audit, Chair; Management Development and Compensation Age: 75 | Expiration of term, 2005. Mr. Fetterolf was President and Chief Operating Officer of Aluminum Company of America, Inc. (Alcoa) from 1985 to 1991, and served as President of Alcoa from 1983 to 1985. He is a Director of Allegheny Technologies, Inc. and member of its Compensation Committee and Technology Committee. He formerly served as Chair of the Audit Committee for Mellon Bank, NA, Chair of the Audit Committee of Praxair, Inc. and member of the Audit Committee of Union Carbide Corp. | ||

8

| Mark V. Kaminski President and Chief Executive Officer, Commonwealth Industries, Inc. Director since 1990 Age: 48 | Expiration of term, 2005. Mr. Kaminski joined the Company in 1987 as Marketing Manager. In 1989 he was promoted to Vice President Operations, and in 1991 he became President and Chief Executive Officer. Mr. Kaminski is a Director of Secat, Inc. (a research company affiliated with the University of Kentucky). | ||

| Larry E. Kittelberger Senior Vice President, Administration and Chief Information Officer, Honeywell International Inc. Director since 2000 Committees – Audit; Nominating and Corporate Governance Age: | Expiration of term, | ||

9

5

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE REPORT

CONTINUING DIRECTORS

| ||||

| ||||

| ||||

| ||||

| ||||

6

COMMITTEES AND MEETINGS OF THE BOARD

The Board of Directors is comprised of four directors and met 11five times in 2002 and the number of meetings for each committee is reflected below. Attendance by directors at Board and committee meetings averaged over 91%. All directors attended at least 83% of the Board and committee meetings.2003. The Board of Directors has determined that committee members have no financial ties to the following standing committees: Audit Committee, Management DevelopmentCompany (other than director compensation and Compensation Committeeequity ownership as described in this proxy statement) and, as required by the committee’s charter, meet Nasdaq standards for independence. The Nominating and Corporate Governance Committee. Committee operates under a written charter setting out the functions and responsibilities of this committee. A copy of the amended and restated charter is attached hereto as Exhibit A and can also be viewed on the Company’s website on the Investor Relations — Corporate Governance page at www.ciionline.com.

PROCESS FOR NOMINATING DIRECTORS

The tableNominating and Corporate Governance Committee identifies director nominees from various sources such as officers, directors, stockholders and third party consultants. In 2003, the committee did not retain the services of any third party consultants to assist in identifying and evaluating potential nominees. The committee will consider and evaluate a director candidate recommended by a stockholder in the same manner as other nominees. The committee will assess all director nominees taking into account several factors, including, but not limited to, issues such as the current needs of the board and the nominee’s: (i) integrity, honesty and accountability, (ii) experience and expertise relevant to the Company’s business, (iii) ability and willingness to commit adequate time to board and committee matters, (iv) fit of personality and skills in harmony with those of other directors and potential directors in building a board that is effective, collegial and responsive to the needs of the Company and (v) independence and absence of conflicts of interest. The committee does not set specific minimum qualifications for nominees. The committee’s review of a director nominee typically is based on any written materials provided with respect to the candidate. Additional information or an interview may be sought if the committee determines that would be appropriate.

STOCKHOLDER NOMINATIONS

Under the Company’s by-laws, nominations for director may be made only to the board or a board committee or by a stockholder of record entitled to vote. In order for a stockholder to make a nomination, the stockholder must provide advance notice to the Company, along with the additional information and materials required by the by-laws, to the Company’s Corporate Secretary at the below describesaddress not less than sixty days nor more than ninety days prior to the Board’s standing committees:

710

notice on or after January 21, 2005 and before February 21, 2005. You can obtain a copy of the full text of the by-laws provision by writing to the Corporate Secretary, PNC Plaza — 19th Floor, 500 West Jefferson Street, Louisville, Kentucky 40202. The by-laws can also be viewed at the Company’s website on the Investor Relations — Corporate Governance page at www.ciionline.com. The Company received no stockholder proposals or nominations during the year.

Nominating and Corporate Governance Committee

John E. Merow, Chair

Catherine G. Burke

Larry E. Kittelberger

Paul E. Lego

COMPENSATION AND OTHER TRANSACTIONS WITH DIRECTORS

The Company does not pay directors who are also officers of the Company additional compensation for their service as directors. DirectorsIn 2003, directors who arewere not employees of the Company arewere paid the following:

| • | ||||

| An annual retainer of $15,000 ($30,000 for the Chairman of the | ||||

| An additional annual retainer of $5,000 for the | ||||

| An attendance fee of $1,000 for each day on which a meeting of the | ||||

| An attendance fee of $500 for each | ||||

| Expenses incurred when attending | ||||

Under the 1997 Stock Incentive Plan, as amended, non-employee directors are entitled to an annual automatic grant of:

| • | ||||

| A non-qualified ten-year option to purchase 10,000 shares of Company common stock on the date the director becomes a non-employee director and on each succeeding January 1 (exercisable commencing one year from the date issued); and | ||||

| Common stock having a fair market value of $15,000 on the date the director becomes a non-employee director and on each succeeding January 1. | ||||

The option price has been fixed as the “fair market value” of the common stock as of the date of grant, which is defined as the mean between the highest and lowest reported sales price of the common stock on the date issued or, if no common stock was traded on that day, on the nextfirst preceding day on which there was such a trade.

11

The annual automatic option issued to non-employee directors for 2002 of 10,000 shares of common stock was made on January 1, 2002 at an exercise price of $4.851 per share; except for Mr. Demetriou, who was elected a director on April 26, 2002 and who was issued options for 10,000 shares of common stock on that date at an exercise price of $7.275 per share. Each director received a common stock grant of 3,092 shares as of January 1, 2002; except for Mr. Demetriou, who was elected a director on April 26, 2002 and who received a common stock grant of 2,061 shares as of that date. Further, the annual automatic option issued to non-employee directors for 2003 of 10,000 shares of common stock was made on January 1, 2003 at an exercise price of $6.755 per share, and eachshare. Each director received a common stock grant of 2,220 shares as of January 1, 2003. Further, each director received a common stock grant of 1,571 shares as of January 1, 2004 at an exercise price of $9.545.

8As of January 1, 2004, directors who were not employees of the Company were paid the following:

| • | An annual retainer of $35,000 ($50,000 for the Chairman of the Board of Directors); | |||

| • | An additional annual retainer of $5,000 for the Chair of a board committee; | |||

| • | An attendance fee of $1,500 for each day on which an in-person meeting of the board or of a board committee occurs; | |||

| • | An attendance fee of $1,000 for each telephonic meeting, including meetings that the Audit Committee holds prior to an earnings release or prior to filing the Company’s periodic report on Form 10-Q’s or Form 10-K; | |||

| • | Expenses incurred when attending board and committee meetings; and | |||

| • | Under the 1997 Stock Incentive Plan, as amended, an annual automatic grant of common stock having a fair market value of $15,000 on the date the director becomes a non-employee director and on each succeeding January 1. | |||

The provision providing for the automatic grant of an option to purchase 10,000 shares of Company common stock on the date the director becomes a non-employee director and on each succeeding January 1 has been terminated with no grants made as of January 1, 2004.

12

AUDIT COMMITTEE ANNUAL REPORT

The Audit Committee of the Board of Directors is comprised of four directors and met 11fifteen times in 2002.2003. The Board of Directors in its business judgment, has determined that allthe Audit Committee members have no financial or personal ties to the Company (other than director compensation and equity ownership as described in this proxy statement) and meet Nasdaq standards for independence.

The Board of Directors has determined that C. Frederick Fetterolf meets the criteria of an “audit committee financial expert” (defined by SEC regulations) as a result of his experience in corporate executive positions, including having held the position of Chief Operating Officer of Alcoa, having served as Chair of the Audit Committees for Mellon Bank, NA and Praxair, Inc. and as a member of the Audit Committee are “independent”of Union Carbide Corp. The Board of Directors has also determined that at least one member of the Audit Committee meets Nasdaq standards regarding accounting or related financial management experience and, “financially literate,” as required by applicable listing standardsconcurrently, the Board of NASDAQ. Directors has determined that each of the members meet the “financial literacy” requirements of Nasdaq standards.

The Audit Committee operates under a written charter adopted by the Board of Directors, last revised in December 2002which is reviewed annually and amended, as required, to reflect changes incorporated as a result of the Sarbanes-Oxley Act of 2002 and rule changes adopted by the SEC and NASDAQ.Nasdaq. The Audit Committee Charter ischarter was attached as Exhibit Ban exhibit to thisthe 2003 proxy statement and is also availablecan be viewed on the Company’s website on the Investor Relations - - Corporate Governance page at www.ciionline.com/InvestorRelations/Corporate Governance.www.ciionline.com.

As set forth in the Audit Committee Charter,charter, the purpose of the Audit Committee is to assist the Boardwith board oversight of:

| • | ||||

| The integrity of the Company’s financial statements; | ||||

| The Company’s compliance with legal and regulatory requirements; | ||||

| The independent auditor’s qualifications and independence; | ||||

| The performance of the independent auditors and the Company’s internal audit function; and | ||||

| The Company’s compliance and conflict of interest policies and procedures. | ||||

It is also the purpose of the Audit Committee:

| • | ||||

| To provide an open avenue of communication among the independent auditors, financial | ||||

| • | To receive complaints related to accounting, internal accounting controls or auditing matters; and | |||

| To encourage continuous improvement of and to foster adherence to the Company’s accounting, financial reporting, conflict of interest and compliance policies, procedures and practices. | ||||

13

The Audit Committee Chartercharter provides that management is responsible for the preparation, presentation and integrity of the Company’s financial statements, the Company’s accounting and financial reporting principles and internal controls, and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Company’s independent auditors, PricewaterhouseCoopers LLP, are responsible for performing an independent audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States and for reporting thereon.

In performing its oversight role, the Audit Committee met with management periodically during the year to consider the adequacy of the Company’s internal controls and the objectivity of its financial reporting. Reference is made to the disclosure in Item 9A of the Company’s Annual Report on Form 10-K for fiscal year 2003 regarding the Company’s internal controls. The Audit Committee has reviewed, considered and discussed these matters and the audited financial statements prior to issuance with both management and the Company’s independent auditors. The Audit Committee regularly met privately with both the independent auditors and the internal auditors, each of whom has unrestricted access to the Committee.committee. The Audit Committee also met privately with appropriate executive management.management, including the Chief Financial Officer and the General Counsel, each of whom has unrestricted access to the Audit Committee. Management advised the Audit Committee in each case that all financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and reviewed significant issues with the Audit Committee. The independent auditors: (a) audited the financial statements prepared by management, (b) expressed an opinion as to whether those financial statements fairly present the financial position, results of operations and cash flows of the Company in conformity with accepted accounting principles generally accepted in the United

9

As part of these reviews, the Audit Committee has also discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 61,Communication with Audit Committees,as currently in effect (as amended by Statement on Auditing Standards No. 90) (Codification of Statements on Auditing Standards, AU Section 380). The Audit Committee implemented a procedure to monitor auditor independence, reviewed non-audit services performed by PricewaterhouseCoopers LLP and discussed with the auditors their independence. Further, the Audit Committee received from and discussed with PricewaterhouseCoopers LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit CommitteesCommittees.. These items relate to that firm’s independence from the Company.

The Audit Committee reviewed with the independent auditors, executive management, internal auditors and appropriate Company financial personnel major initiatives and programs aimed at strengthening the effectiveness of the Company’s internal control structure and the objectivity of financial reporting. As part of the process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal auditing program, reviewing steps taken to implement recommended improvements in internal procedures and controls. Reference is made to the disclosure in Item 9A of the Company’s Annual Report on Form 10-K for fiscal year 2003 regarding findings related to the Company’s internal controls. The Audit Committee also discussed with the Company’s executive management, appropriate Company financial personnel, internal auditors and independent auditors the process used for certifications by the Company’s Chief Executive Officer and Chief Financial Officer, as required by the SEC and the Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the SEC.

14

The Audit Committee recommended to the Board of Directors the appointment ofappointed PricewaterhouseCoopers LLP as the independent auditors for the Company for 20022003 and appointed PricewaterhouseCoopers LLP as the independent auditors for 20032004 after reviewing the firm’s performance and independence from management.

Taking all of these reviews and discussions into account, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for fiscal year ended December 31, 20022003 for filing with the SEC.

Audit Committee

C. Frederick Fetterolf, Chair

10

EMPLOYEE CODE OF CONDUCT

The Board of Directors has approved a Code of Conduct that applies to all directors, officers and employees, ofand the Company. The Company requires that all directors, officers and employees adhere to the Code of Conduct addressing legal and ethical issues encountered in day-to-day activities.Conduct. The Code of Conduct, among other things, requires that all directors, officers and employees avoid conflicts of interest, comply with all laws and legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interests. All directors, officers, managers and certain other employees are required to annually certify as to any actual or potential conflicts of interest between the employee and the Company. Any waivers or any amendments thereto of the Code of Conduct must be approved by the Board of Directors.

The Company has implemented a Compliance Program pursuant to which training is provided to all employees regarding the Code of Conduct and other legal and employment obligations. Employees are required to report any conduct that the employee believes in good faith to be an actual or apparent violation of the Code of Conduct. The Company has established and communicated to all employees the process by which confidential anonymous submissions of any report, complaint, concern or question regarding questionable accounting, auditing matters or other conduct may be reported. Further, the Audit Committee of the Board of Directors has established procedures to receive, retain and address any complaints, issues or questions regarding internal accounting controls, audit matters or audit matters.other matters related to the compliance program.

The Company has filed a copy of the Code of Conduct with the SEC as an exhibit to its December 31, 2003 Annual Report on Form 10-K. A copy of the Code of Conduct is also posted on the Company’s website on the Investor Relations - Corporate Governance page at www.ciionline.com.

15

RELATIONSHIP WITH INDEPENDENT PUBLIC AUDITORS

AUDIT AND NON-AUDIT FEESThe Audit Committee has appointed PricewaterhouseCoopers LLP as the independent public accounting firm to audit the Company’s financial statements for the fiscal year beginning January 1, 2004. In making this appointment, the Audit Committee considered whether the audit and non-audit services to be provided by PricewaterhouseCoopers LLP are compatible with maintaining the independence of the Company’s outside auditors. The Audit Committee has adopted a policy and procedures to set forth the manner in which the Audit Committee shall review and approve all services to be provided by PricewaterhouseCoopers LLP before the firm is retained. A copy of the policy and procedures is attached to this proxy statement as Exhibit B.

The following table sets forth the aggregate fees charged by PricewaterhouseCoopers LLP for professional services rendered for the years December 31, 20022003 and 2001, of which $247,189 and $288,699 had been billed as of December 31, 2002 and 2001, respectively.

| Audit Fees | 2002 | 2001 | ||||||||

| Audit of Financial Statements | $265,358 | $235,224 | ||||||||

| Audit Related Accounting Assistance | 26,826 | 20,873 | ||||||||

| Total Audit Fees | 292,184 | 256,097 | ||||||||

Audit Related Fees | ||||||||||

| State Incentive Tax Credit Procedures | 3,000 | 3,000 | ||||||||

| Audit of Employee Benefit Plans | 76,300 | 71,452 | ||||||||

| Total Audit Related Fees | 79,300 | 74,452 | ||||||||

Tax Compliance Fees | 5,300 | 17,387 | ||||||||

TOTAL FEES | $376,784 | $347,936 | ||||||||

| Services | 2003 | 2002 | ||||||

| Audit Fees | ||||||||

| Audit of Financial Statements | $ | 518,500 | $ | 292,184 | ||||

| Total Audit Fees | $ | 518,500 | $ | 292,184 | ||||

| Audit Related Fees | ||||||||

| Audit of Employee Benefit Plans | $ | 83,000 | $ | 76,300 | ||||

| State Incentive Tax Credit Procedures | $ | 3,000 | $ | 3,000 | ||||

| Review of Controls/System 2.0 Project (Information System Redesign Project) | $ | 19,000 | $ | 0 | ||||

| Review of Implementation Status of JD Edwards Systems | $ | 10,000 | $ | 0 | ||||

| Internal Control Consultation/Section 404 | $ | 15,000 | $ | 0 | ||||

| Due Diligence Consultation | $ | 3,500 | $ | 0 | ||||

| Total Audit Related Fees | $ | 133,500 | $ | 79,300 | ||||

| Tax Fees | ||||||||

| Tax Compliance | $ | 0 | $ | 5,300 | ||||

| Total Tax Fees | $ | 0 | $ | 5,300 | ||||

| All Other Fees | ||||||||

| Use of Compario Accounting Database | $ | 1,400 | $ | 0 | ||||

| Total All Other Fees | $ | 1,400 | $ | 0 | ||||

| TOTAL FEES FOR ALL SERVICES | $ | 653,400 | $ | 376,784 | ||||

1116

BENEFICIAL OWNERSHIP OF COMMON STOCK

OWNERSHIP BY OTHERS

The following table sets forth information with respect to each person believed by the Company to be the beneficial owner of 5% or more than 5% of the Company’s common stock on the dates noted.

| PERCENT OF | ||||||||

| NAME AND ADDRESS | NUMBER OF | CLASS(h) | ||||||

| OF BENEFICIAL OWNER | SHARES OWNED | |||||||

| IRONWOOD CAPITAL MANAGEMENT, LLC | 1,803,073 | (a) | 11.3 | % | ||||

| 21 CUSTOM HOUSE STREET | ||||||||

| BOSTON, MASSACHUSETTS 02110 | ||||||||

| JOHN R. SIMPLOT | 1,622,400 | (b) | 10.1 | % | ||||

| SELF-DECLARATION OF REVOCABLE TRUST | ||||||||

| 999 MAIN STREET | ||||||||

| BOISE, IDAHO 83702 | ||||||||

| HEARTLAND ADVISORS, INC. | 1,384,797 | (c) | 8.6 | % | ||||

| 789 NORTH WATER STREET | ||||||||

| MILWAUKEE, WISCONSIN 53202 | ||||||||

| DIMENSIONAL FUND ADVISORS | 1,378,500 | (d) | 8.6 | % | ||||

| 1299 OCEAN AVENUE, 11TH FLOOR | ||||||||

| SANTA MONICA, CALIFORNIA 90401 | ||||||||

| FRANKLIN RESOURCES, INC. | 930,000 | (e) | 5.8 | % | ||||

| ONE FRONTIER PARKWAY | ||||||||

| SAN MATEO, CALIFORNIA 94404 | ||||||||

| DONALD SMITH & CO., INC. | 824,000 | (f) | 5.1 | % | ||||

| EAST 80 ROUTE 4 SUITE 360 | ||||||||

| PARAMUS, NEW JERSEY 07652 | ||||||||

| MERRILL LYNCH INVESTMENT MANAGER, L.P. | 815,600 | (g) | 5.1 | % | ||||

| 800 SCUDDER MILL ROAD | ||||||||

| PLAINSBORO, NEW JERSEY 08536 | ||||||||

| Name and Address | Number of | Percent of | ||||||

| of Beneficial Owner | Shares Owned | Class (g) | ||||||

| Ironwood Capital Management, LLC 21 Custom House Street Boston, Massachusetts 02110 | 1,401,725 | (a) | 8.75 | % | ||||

| J.R. Simplot and J.R. Simplot, as trustee Self-Declaration of Revocable Trust 999 Main Street Boise, Idaho 83702 | 1,270,900 | (b) | 7.93 | % | ||||

| Dimensional Fund Advisors 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | 1,239,167 | (c) | 7.73 | % | ||||

| Heartland Advisors, Inc. 789 North Water Street Milwaukee, Wisconsin 53202 | 1,097,100 | (d) | 6.85 | % | ||||

| Merrill Lynch Investment Manager, L.P. World Financial Center, North Tower 250 Vesey Street New York City, New York 10381 | 815,600 | (e) | 5.03 | % | ||||

| Franklin Resources, Inc. One Frontier Parkway San Mateo, California 94404 | 800,000 | (f) | 5.00 | % | ||||

(Footnotes on following page.)

17

(a) Based solely on a Schedule 13G dated March 11, 2003February 17, 2004 filed with the SEC by Ironwood Capital Management, LLC. The Schedule 13G reports that the shares are beneficially owned by Ironwood Capital Management, LLC, Warren J. Isabelle, Richard L. Droster, Donald Collins, and that each has shared power to dispose of or direct the disposition of all of the above-noted shares.

(b) Based solely on a Form 4Amendment Number 8 to Schedule 13D dated February 28, 2003January 12, 2004 filed with the SEC by J.R. Simplot and J.R. Simplot, as Trustee, J.R. Simplot Self-Declaration of Revocable Trust (the “Trust”). Simplot and the Trust reported sole power to vote and dispose of all of the above-noted shares of common stock.

(c) Based solely on a Schedule 13G dated February 13, 20036, 2004 filed with the SEC by Dimensional Fund Advisors, Inc. Dimensional reported sole power to vote and dispose of all of the above-noted shares of common stock.

(d) Based solely on a Schedule 13G dated February 12, 2004 filed with the SEC by Heartland Advisors, Inc. and William J. Nasgovitz. The Schedule 13G reports that Heartland Advisors, Inc. and William J. Nasgovitz, jointly, have sole power to vote and dispose of all of the above-noted shares of common stock.

(d)(e) Based solely on a Schedule 13G dated February 3, 2003January 27, 2004 filed with the SEC by Dimensional Fund Advisors,Merrill Lynch & Co, Inc. Dimensionalon behalf of Merrill Lynch Investment Managers. Merrill Lynch reported soleshared voting power to vote and dispose of all of the above-noted shares of common stock.

(e)(f) Based solely on a Schedule 13G13G/A dated February 12, 20032004 filed with the SEC by Franklin Resources, Inc., Franklin Advisory Services, LLC, Charles B. Johnson and Rupert H. Johnson, Jr. The Schedule 13G13G/A reports that: (1) the shares are beneficially owned by investment companies or other managed accounts which are advised by investment advisory subsidiaries of Franklin Resources, Inc.; (2) advisory contracts grant to such advisory subsidiaries all voting and investment power over the shares; (3) Charles B. Johnson and Rupert H. Johnson, Jr. are principal stockholders of Franklin Resources, Inc.; and (4) Franklin Advisory Services, LLC has sole power to vote and dispose of all of the above-noted shares.

(f) Based solely on a Schedule 13G dated January 17, 2003 filed with the SEC. Donald Smith & Co., Inc. reported sole power to vote and dispose of all of the above-noted shares of common stock.

(g) Based solely on information obtained by the Company and a Schedule 13G dated January 30, 2002 filed with the SEC. Merrill Lynch reported shared voting power to vote and dispose of all of the above-noted shares of common stock.

(h) Calculations based on outstanding shares as of March 7, 2003.5, 2004.

1218

OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as of March 1, 2003,2004, the number of shares of common stock of the Company beneficially owned by each director, each executive officer named in the Summary Compensation Table appearing on page 19,later in this proxy statement, and all directors and executive officers as a group, and the percentage of the common stock such ownership represented on that date.

Each person has sole investment and voting power with respect to the shares set forth below unless otherwise noted.

| COMMON STOCK | ||||||||||||||||

| COMMON | BENEFICIAL OWNER HAS | |||||||||||||||

| STOCK | THE RIGHT TO ACQUIRE | |||||||||||||||

| BENEFICIALLY | NOT INCLUDED IN | PERCENT | ||||||||||||||

| NAME OF BENEFICIAL OWNER | OWNED (1) | PREVIOUS COLUMN (2) | TOTAL | OF CLASS | ||||||||||||

| CATHERINE G. BURKE | 18,034 | 31,500 | 49,534 | * | ||||||||||||

| STEVEN J. DEMETRIOU | 4,281 | 0 | 4,281 | * | ||||||||||||

| C. FREDERICK FETTEROLF | 16,034 | 29,500 | 45,534 | * | ||||||||||||

| MARK V. KAMINSKI | 154,447 | 340,000 | 494,447 | 3.1% | ||||||||||||

| LARRY E. KITTELBERGER | 10,883 | 25,000 | 35,883 | * | ||||||||||||

| PAUL E. LEGO | 14,034 | 37,500 | 51,534 | * | ||||||||||||

| JOHN E. MEROW | 30,034 | 31,500 | 61,534 | * | ||||||||||||

| DONALD L. MARSH JR. | 37,128 | 100,000 | 137,128 | * | ||||||||||||

| JOHN J. WASZ | 25,003 | 28,000 | 53,003 | * | ||||||||||||

| PATRICK D. KING | 0 | 0 | 0 | * | ||||||||||||

| WILLIAM R. WITHERSPOON | 2,755 | 15,000 | 17,755 | * | ||||||||||||

| MICHAEL J. BOYLE | 900 | — | (3) | 900 | * | |||||||||||

| ALL DIRECTORS AND EXECUTIVE OFFICERS AS A GROUP (18 PERSONS) | 343,037 | 683,500 | 1,026,537 | 6.4% | ||||||||||||

| * LESS THAN 1.00% | ||||||||||||||||

| Common Stock | ||||||||||||||||

| Beneficial Owner has | ||||||||||||||||

| Common Stock | the Right to Acquire | |||||||||||||||

| Beneficially Owned | Not Included in | Percent | ||||||||||||||

| Name of Beneficial Owner | (a) | Previous Column (b) | Total | of Class | ||||||||||||

| Catherine G. Burke | 19,605 | 41,500 | 61,105 | * | ||||||||||||

| Steven J. Demetriou | 5,825 | 20,000 | 25,852 | * | ||||||||||||

| C. Frederick Fetterolf | 17,605 | 39,500 | 57,105 | * | ||||||||||||

| Mark V. Kaminski | 154,727 | 440,000 | 594,727 | 3.7 | % | |||||||||||

| Larry E. Kittelberger | 12,454 | 35,000 | 47,454 | * | ||||||||||||

| Paul E. Lego | 15,605 | 47,500 | 63,105 | * | ||||||||||||

| John E. Merow | 31,605 | 41,500 | 73,105 | * | ||||||||||||

| Donald L. Marsh Jr. | 39,165 | 135,000 | 174,165 | * | ||||||||||||

| John J. Wasz | 18,914 | 63,000 | 81,914 | * | ||||||||||||

| Patrick D. King | 1,346 | 0 | 1,346 | * | ||||||||||||

| William R. Witherspoon | 0 | 20,000 | 20,000 | * | ||||||||||||

| All Directors and Executive Officers as a group (16 persons) | 346,900 | 935,000 | 1,281,900 | 8.0 | % | |||||||||||

(1)*Less than 1.00%

(Footnotes on following page.)

19

(a) Includes shares held in the Company’s 401(k) Plan for the accounts of individuals as follows: Mr. Kaminski – 6,7197,939 shares; Mr. Marsh – 5,7697,504 shares; Mr. Wasz – 17,362 shares;18,794; Mr. King – 01,346 shares; Mr. Witherspoon – 2,788 shares; Mr. Boyle – 0 shares; and executive officers as a group (12(10 persons) – 52,20356,633 shares. Also, includes restricted stock units held in Company stock accounts underJune 2003 the Company’s Deferred Compensation Plan for the accounts of individualswas terminated and stock was distributed as follows: Mr. Kaminski – 54,58453,644 shares; Mr. Marsh – 17,03517,179 shares; and Mr. Wasz – 141120 shares. Also includes shares held in the Company’s Dividend Reinvestment Plan by Mr. Marsh – 1,8241,982 shares.

(2)(b) Shares of common stock that the individual had the right to acquire within 60sixty days of March 1, 20032004 through the exercise of options.

(3) Mr. Boyle separated from the Company effective September 4, 2002 and all vested and unvested stock options terminated for no value on September 4, 2002.

13

COMPLIANCE WITH SECTION 16(a)16(A) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and officers and persons who beneficially own more than 10% of its common stock (“reporting persons”) to file reports of ownership and changes in ownership with the SEC and furnish a copy thereof to the Company. Based solely upon a review of the copies of such forms furnished to the Company records and other information and written representations from certain reporting persons, the Company believes that all of the reporting persons complied with all applicable filing requirements applicable to them with respect to 2002.2003.

20

PERFORMANCE GRAPH

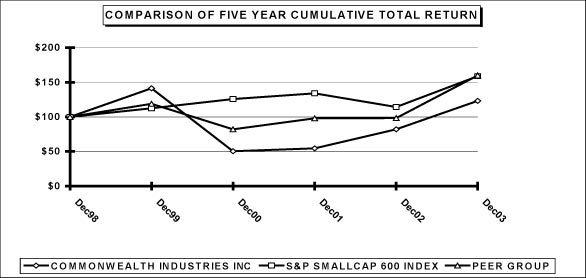

The following graph compares the cumulative total stockholder return on the Company’s common stock with that of Standard & Poor’s Small Cap 600 and a peer group index. The graph assumes that the value of the investmentinvested in the Company’s common stock and each index was $100 at December 31, 19971998 and that all dividends (where applicable) were reinvested. The data is provided in table format below.

The peer group selected by the Company consists of Century Aluminum Company, IMCO Recycling, Inc., Steel Dynamics, Inc., Quanex Corporation, Steel Dynamics, Inc., Steel Technologies, Inc., Century Aluminum Company and Wolverine Tube, Inc. The self-determined peer group has not been modified from the peer group noted in the 20022003 proxy statement to remove Birmingham Steel Corporation and Kaiser Aluminum Corporation, for which no comparative information was available due to delisting by virtue of acquisition and bankruptcy filing, respectively. Century Aluminum Company and Wolverine Tube, Inc. were added to the peer group as replacements.statement.

| 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | |||||||||||||||||||

| Commonwealth Industries, Inc. | $ | 100.00 | $ | 141.19 | $ | 50.36 | $ | 54.56 | $ | 81.94 | $ | 123.19 | ||||||||||||

| S&P Small Cap 600 | $ | 100.00 | $ | 112.40 | $ | 125.67 | $ | 133.88 | $ | 114.30 | $ | 158.63 | ||||||||||||

| Peer Group Index | $ | 100.00 | $ | 118.95 | $ | 81.67 | $ | 97.87 | $ | 98.21 | $ | 159.92 | ||||||||||||

1421

EXECUTIVE COMPENSATION

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE REPORT

The Management Development and Compensation Committee of the Board of Directors (the “Committee”) consists entirely of “non-employee directors”independent directors under Rule 16b-3 of the Securities Exchange Act of 1934Nasdaq standards and “outside directors” under Section 162(m) of the Internal Revenue Code. The Committeecommittee operates under a written charter adopted by the Board of Directors last revised in October 2002, which isand reviewed annually. The Management Development and Compensation Committee Charter was attached as Exhibit Can as an exhibit to thisthe 2003 proxy statement and is also availablecan be viewed on the Company’s website on the Investor Relations — Corporate Governance page at www.ciionline.com/Investor Relations/Corporate Governance.www.ciionline.com.

The Committeecommittee approves the policies and practices under which compensation is paid or awarded to the Company’s executive officers. The Committeecommittee from time to time considers the advice of independent outside consultants and experts in determining the appropriateness of the level and composition of compensation.

Compensation Philosophy. The Committeecommittee believes that compensation opportunities must compare favorably with those found in comparable sectors if the Company is to attract and retain executives with the capability to meet corporate business objectives. The Company rewards differentially based upon the complexity, scope and impact of the work required in a role and the work performance of the role incumbent. Individual recognition and rewards are linked to corporate objectives. The Committeecommittee believes that executive officers should have a significant portion of their compensation “at risk” and tied to the long-term performance of the Company’s stock.

Compensation Program. The Company’s compensation program for executive officers consists of three key elements:

| • | ||||

| Base salary; | ||||

| • | Annual incentive compensation; and | |||

| • | Long-term incentive compensation. | |||

Executive Compensation Guiding Principles.

| • | Compensation should be related to performance (individual and Company performance measured against both financial and non-financial goals and objectives); | |||

| • | Incentive compensation should be a greater part of total compensation for executive positions (the proportion of an employee’s total compensation that varies with performance should increase as the scope and level of the individual’s responsibilities increase); | |||

22

| • | Incentive compensation should balance short- and long-term performance (through the design of the Company’s compensation program, the committee looks to balance the focus of all employees on achieving strong short-term, or annual, results in a manner that will ensure the Company’s long-term viability and success); | |||

| • | Compensation levels should be competitive (to achieve the stated goals, the committee has reviewed compensation survey data from independent sources to ensure that total compensation is competitive and the Company targets executive compensation to deliver pay levels between the 50th and 75th percentile of a comparison group); and | |||

| • | The committee seeks to maximize the tax deductibility of compensation as appropriate. | |||

The Committeecommittee believes that thisthese principles best servesserve the interests of stockholders by ensuring the Company’s executive officers are compensated in a way that aligns their interests with those of stockholders. Thus, compensation for the Company’s executive officers places a substantial proportionportion of their comprehensive compensation program is placed “at risk.” Stock options are a substantial portion of the executive officers’ long-term compensation, with a value directly related to the stock price appreciation realized by the Company’s stockholders.

The Committee’scommittee’s judgments concerning executive compensation payments and awards during 20022003 were based upon the Committee’scommittee’s assessment of the Company’s executive officers performance, the continuing demand for superior executive talent, the Company’s overall performance and the Company’s future objectives and challenges.

Base Salary. The purpose of the base salary is to provide compensation that is competitive with that offered by other companies with which the Company competes for executive services. Base salaries of the Company’s executive officers, other than Chief Executive Officer (“CEO”), including any annual or other adjustments, are recommended by the CEO and approved by the Committee,committee, taking into account such factors as competitive industry salaries, a subjective assessment of the natureresponsibilities of the position, the complexity of the work and the contribution and experience of the officer and the length of the officer’s service.officer. The Committeecommittee establishes the base salary of the CEO.CEO in executive session.

15

Annual Incentive Compensation. The purpose of the annual incentive compensation program is to align officer pay with short-term (annual) performance of the Company. In 2002,2003, the annual incentive compensation program gave the CEO the opportunity to earn up to 150% of his base salary (target bonus) and each Executive Vice President the opportunity to earn an annual payment of up to 150% of his base salary. The annual incentive compensation program gave each Vice President the opportunity to earn an annual incentive award of up to 67.5%75% of his or her base salary. Each year the committee defines a minimum annual performance threshold for the Company, the achievement of which funds is an objective component of the target bonus; the remaining portion of the target bonus is tied to a subjective assessment of individual performance. The potential for the performance component of the 2003 incentive award for the year was based first ontied to the Company achieving a specified level of return on capital employed and then upon a subjective judgment of individual performance.employed. The Committeecommittee assesses the work performance of the CEO and all other executives based on histhe individual level of achievement of predetermined annual priority tasks. The incentive award for the Executive Vice Presidents and Vice Presidents is recommended to the Committeecommittee based on the achievement of specific work priorities as judged by the CEO and approved by the Committee.committee.

23

For 20022003 the Company achieveddid not achieve the predetermined rate of return on capital employed and the Committee awardedcommittee determined not to award a subjective component under the incentive compensation for the CEO, based on his achievement of predetermined priority tasks and approved incentive compensation for the Executive Vice Presidents andor Vice Presidents of the Company.

Long-Term Incentive Compensation. The purpose of the long-term incentive compensation program is to align the long-term interests of executive officers with those of the stockholders. Generally, the Committeecommittee makes grants of stock options to executive officers once a year. These options have an exercise price equal to the fair market value of the share on the day of the option grant or, if no common stock was traded that day, on the nextfirst preceding day on which there was such a trade. These options generally vest within three years and expire ten years from the date of the grant.

Chief Executive Officer Compensation. Compensation for the CEO, Mr. Kaminski, reflects the same elements and the same factors as those described above. In February 20022003 the Committeecommittee set Mr. Kaminski’s base salary at $675,000. In 20022003 the annual incentive compensation program (as described above) gave the CEO the opportunity to earn up to 150% of his base salary. Therefore, 60% of Mr. Kaminski’s compensation (base salary plus incentive compensation) was “at risk” and subject to achieving the planned financial performance of the Company and predetermined priority tasks. As the Company achieved a predetermineddid not achieve the financial target for 2002,2003, the Committee awardedcommittee did not award the CEO incentive compensation for 2002. Although the Committee determined incentive compensation based on the Company’s 2002 financial performance, it noted that additional indicators were reviewed regarding the overall performance of Mr. Kaminski: (1) achievement of the 2002 financial plan; (2) improved safety performance; (3) improvement of financial performance through the design and implementation of corporate-wide systems; and (4) execution of a top-line growth strategy through both organic and acquisition growth and refinement of the template for screening strategic investment options. The Board of Directors, under the sponsorship of the Committee, also completed a “360” CEO performance review with the confidential participation of the executive team and members of the Board of Directors. The Board has reviewed with the CEO preliminary results of the “360” review. The Committee believes that the findings of the “360” CEO performance review will assist in setting future CEO performance goals and tasks.2003.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code limits the tax deduction for individual compensation paid to the CEO and the four other most highly paid executives to $1,000,000 paid as of the end of any fiscal year. However, the statute exempts qualifying performance-based compensation from the deduction limit if certain requirements are met.

16

The Committeecommittee believes that it is generally in the Company’s best interest to attempt to structure performance-based compensation, including stock option grants and annual bonuses, to executive officers who may be subject to Section 162(m) in a mannerway that satisfies the statute’sstatute requirements. However, the Committeecommittee also recognizes the need to retain flexibility to make compensation decisions that may not meet Section 162(m) standards whenif necessary to enable the Company to meet its overall objectives, even if the Company may not be able to deduct a portion of the compensation.

Management Development and Compensation Committee

Catherine G. Burke, Chair

1724

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2002:2003:

| • | ||||

| None of the members of the Management Development and Compensation Committee was an officer, | ||||

| None of the members of the Management Development and Compensation Committee entered into | ||||

| None of the Company’s executive officers served on the compensation committee | ||||

| None of the Company’s executive officers was a director of another entity where one of that entity’s executive officers served on the Company’s Management Development and Compensation Committee; and | ||||

| None of the Company’s executive officers served on the compensation committee | ||||

1825

SUMMARY COMPENSATION TABLE

The following table sets forth for years 2000, 2001, 2002 and 20022003 the annual and long-term compensation paid or accrued for those years by the Company to the CEO and the four most highly compensated executives of the Company who were serving as executive officers on December 31, 2002 and one employee whose employment terminated prior to year end2003 (the “named officers”).

| ANNUAL COMPENSATION (a) | LONG-TERM COMPENSATION AWARDS (e) | |||||||||||||||||||||||||||

| BONUS | ||||||||||||||||||||||||||||

| SPECIAL | ||||||||||||||||||||||||||||

| TARGET | ||||||||||||||||||||||||||||

| AWARDS AND | ||||||||||||||||||||||||||||

| TERMINATION | NUMBER | |||||||||||||||||||||||||||

| INCENTIVE | PAYMENTS | OF SHARES | ||||||||||||||||||||||||||

| COMPEN- | UNDER THE | UNDERLYING | ALL OTHER | |||||||||||||||||||||||||

| NAME AND PRINCIPAL | SATION | 1999 | STOCK | COMPEN- | ||||||||||||||||||||||||

| POSITION | YEAR | SALARY | PLAN (c) | PROGRAM (d) | TOTAL | OPTIONS | SATION (f) | |||||||||||||||||||||

| MARK V. KAMINSKI | 2003 | $ | 700,962 | (b) | $ | 0 | $ | 0 | $ | 0 | 100,000 | $ | 49,805 | |||||||||||||||

President and Chief | 2002 | $ | 659,856 | $ | 571,860 | $ | 1,461,182 | $ | 2,033,042 | 100,000 | $ | 47,613 | ||||||||||||||||

Executive Officer | 2001 | $ | 675,004 | $ | 0 | $ | 2,010,437 | $ | 2,010,437 | 100,000 | $ | 45,818 | ||||||||||||||||

| DONALD L. MARSH JR. | 2003 | $ | 364,500 | (b) | $ | 0 | $ | 0 | $ | 0 | 35,000 | $ | 29,172 | |||||||||||||||

Executive Vice President | 2002 | $ | 343,125 | $ | 185,854 | $ | 1,239,253 | $ | 1,425,107 | 35,000 | $ | 53,513 | ||||||||||||||||

and Chief Financial Officer | 2001 | $ | 351,000 | $ | 0 | $ | 1,725,064 | $ | 1,725,064 | 35,000 | $ | 31,293 | ||||||||||||||||

| JOHN J. WASZ | 2003 | $ | 307,190 | (b) | $ | 0 | $ | 0 | $ | 0 | 35,000 | $ | 14,043 | |||||||||||||||

Executive Vice President | 2002 | $ | 279,984 | $ | 214,050 | $ | 316,842 | $ | 530,892 | 35,000 | $ | 12,343 | ||||||||||||||||

and President Alflex | 2001 | $ | 275,004 | $ | 0 | $ | 444,421 | $ | 444,421 | 35,000 | $ | 16,560 | ||||||||||||||||

| PATRICK D. KING | 2003 | $ | 292,558 | (b) | $ | 0 | $ | 0 | $ | 0 | 35,000 | $ | 9,217 | |||||||||||||||

Executive Vice President | 2002 | $ | 148,077 | $ | 146,777 | $ | 0 | $ | 146,777 | 35,000 | $ | 125,180 | ||||||||||||||||

and Chief Commercial Officer (g) | 2001 | — | — | — | — | — | — | |||||||||||||||||||||

| WILLIAM R. WITHERSPOON | 2003 | $ | 210,218 | (b) | $ | 0 | $ | 0 | $ | 0 | 5,000 | $ | 8,958 | |||||||||||||||

Vice President Aluminum | 2002 | $ | 181,902 | $ | 100,444 | $ | 0 | $ | 100,444 | 5,000 | $ | 7,499 | ||||||||||||||||

Operations | 2001 | $ | 188,910 | $ | 0 | $ | 694,061 | $ | 694,061 | 5,000 | $ | 15,212 | ||||||||||||||||

| LONG-TERM | ||||||||||||||||||||||||||||

| ANNUAL COMPENSATION (a) | COMPENSATION | |||||||||||||||||||||||||||

| AWARDS (d) | ||||||||||||||||||||||||||||

| BONUS (b) | ||||||||||||||||||||||||||||

| SPECIAL TARGET | ||||||||||||||||||||||||||||

| AWARDS AND | NUMBER | |||||||||||||||||||||||||||

| INCENTIVE | TERMINATION PAYMENTS | OF SHARES | ||||||||||||||||||||||||||

| NAME AND PRINCIPAL | COMPENSATION | UNDER THE 1999 | UNDERLYING | ALL OTHER | ||||||||||||||||||||||||

| POSITION | YEAR | SALARY | PLAN (b) | PROGRAM (c) | TOTAL | STOCK OPTIONS | COMPENSATION (e) | |||||||||||||||||||||

MARK V. KAMINSKI | 2002 | $659,856 | $571,860 | $1,461,182 | $2,033,042 | 100,000 | $47,613 | |||||||||||||||||||||

President and Chief | 2001 | $675,004 | $0 | $2,010,437 | $2,010,437 | 100,000 | $45,818 | |||||||||||||||||||||

Executive Officer | ||||||||||||||||||||||||||||

| 2000 | $650,004 | $0 | $0 | $0 | 100,000 | $49,631 | ||||||||||||||||||||||

DONALD L. MARSH JR. | 2002 | $343,125 | $185,854 | $1,239,253 | $1,425,107 | 35,000 | $53,513 | |||||||||||||||||||||

Executive Vice President | 2001 | $351,000 | $0 | $1,725,064 | $1,725,064 | 35,000 | $31,293 | |||||||||||||||||||||

and Chief Financial Officer | ||||||||||||||||||||||||||||

| 2000 | $340,002 | $0 | $0 | $0 | 35,000 | $23,640 | ||||||||||||||||||||||

JOHN J. WASZ | 2002 | $279,984 | $214,050 | $316,842 | $530,892 | 35,000 | $12,343 | |||||||||||||||||||||

Executive Vice President | 2001 | $275,004 | $0 | $444,421 | $444,421 | 35,000 | $16,560 | |||||||||||||||||||||

and President Alflex | ||||||||||||||||||||||||||||

| 2000 | $192,000 | $40,000 | $0 | $40,000 | 5,000 | $13,335 | ||||||||||||||||||||||

PATRICK D. KING | 2002 | $148,077 | $146,777 | — | $146,777 | 35,000 | $125,180 | |||||||||||||||||||||

Executive Vice President | 2001 | — | — | — | — | — | — | |||||||||||||||||||||

and Chief Commercial | ||||||||||||||||||||||||||||

Officer(f) | 2000 | — | — | — | — | — | — | |||||||||||||||||||||

WILLIAM R. WITHERSPOON | 2002 | $181,902 | $100,444 | — | $100,444 | 5,000 | $7,499 | |||||||||||||||||||||

Vice President | 2001 | $188,910 | $0 | $694,061 | $694,061 | 5,000 | $15,212 | |||||||||||||||||||||

Aluminum Operations | ||||||||||||||||||||||||||||

| 2000 | $161,850 | $84,971 | $0 | $84,971 | 5,000 | $13,208 | ||||||||||||||||||||||

MICHAEL J. BOYLE | 2002 | $104,033 | — | — | — | — | $178,716 | |||||||||||||||||||||

Vice President Materials | 2001 | $148,930 | $0 | $0 | $0 | — | $5,561 | |||||||||||||||||||||

(Separated September 4, | ||||||||||||||||||||||||||||

2002)(g) | 2000 | $123,539 | $28,968 | $0 | $28,968 | — | $4,184 | |||||||||||||||||||||

(Footnotes on following page)page.)

1926

SUMMARY COMPENSATION TABLE FOOTNOTES

(a) Compensation deferred at the election of the named officer is included in the category and year in which it would have otherwise been reported had it not been deferred.

(b) The annual 2003 approved base salaries were: Mr. Kaminski – $675,000, Mr. Marsh – $351,000, Mr. Wasz – $297,417, Mr. King – $281,722 and Mr. Witherspoon – $203,530. However, due to the timing of payroll periods, an additional pay period was paid during 2003 for a total of 27 pay periods.

(c) The amounts reported in this column represent payments made with respect to 2000 and 2002 under the Company’s incentive compensation plan. No payments were made with respect to 2001 or 2003 under the Company’s incentive compensation plan.

(c)(d) In December 2001 the Management Development and Compensation Committee terminated the 1999 Executive Stock Purchase Incentive Program (the “1999 Program”). The amounts reported represent payments made pursuant to the 1999 Program: (i) performance-based Special Target Award (Annual Performance Award) payments made in 2000 (no Annual Performance Award paid in 2001 or 2002 with respect to 2000 or 2001) under the 1999 Program; (ii) non-performance based Service Award payments made in April 2001 under the 1999 Program as follows: Mr. Kaminski — $535,000;– $535,000, Mr. Marsh — $473,721;– $473,721, Mr. Wasz — $124,949;– $124,949 and Mr. Witherspoon —– $110,535; and Mr. Boyle — $0; and (iii)(ii) termination payments on termination of the 1999 Executive Stock Purchase Incentive Program: Mr. Kaminski — $1,475,437 first installment payment made in 2001 and $1,461,182 second installment payment made in 2002 for a total termination payment of $2,936,619;$2,936,619, Mr. Marsh —– $1,251,343 first installment payment made in 2001 and $1,239,253 second installment payment made in 2002 for a total termination payment of $2,490,596;$2,490,596, Mr. Wasz —– $319,472 first installment payment made in 2001 and $316,386 second installment payment made in 2002 for a total termination payment of $635,858;$635,858, and Mr. Witherspoon —– $583,526 total termination payment made in 2001; and Mr. Boyle — $0 payment made.2001.

(d)(e) No amounts of restricted stock were awarded during 2000, 2001, 2002 or 2002.2003. No long-term incentive payments were made during 2000, 2001, and 2002.2002 or 2003.